Car title loans Port Arthur TX provide quick cash solutions using personal vehicles as collateral, with streamlined online processes and flexible terms. Same-day approvals, transparent communication, and easy applications are key features of top lenders. These loans offer unparalleled speed and convenience compared to traditional methods, catering to urgent financial needs even for those with less-than-perfect credit.

Car title loans Port Arthur TX have emerged as a popular financial solution, offering quicker access to cash compared to traditional loans. Understanding this unique lending option is crucial for residents seeking immediate funds. This article delves into the intricacies of car title loans in Port Arthur, highlighting key features that differentiate lenders and the benefits they provide to borrowers. By exploring these aspects, we aim to empower individuals to make informed decisions about their financial needs in Port Arthur TX.

- Understanding Car Title Loans in Port Arthur TX

- Key Features That Differentiate Lenders

- Benefits and How They Impact Borrowers

Understanding Car Title Loans in Port Arthur TX

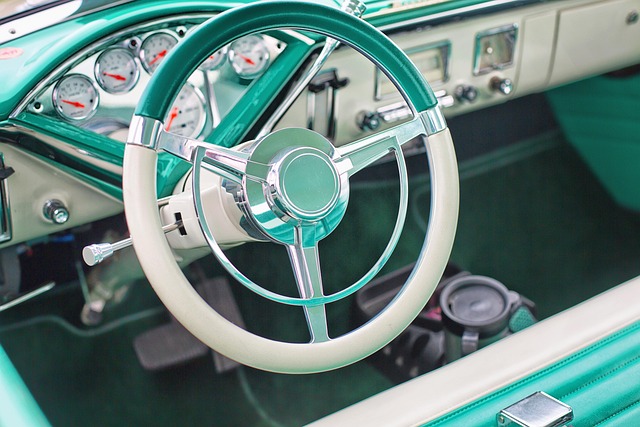

In Port Arthur TX, car title loans have emerged as a popular financial solution for many individuals seeking quick cash. This alternative lending option involves using one’s vehicle—typically their car—as collateral to secure a loan. Here, the title transfer acts as the legal binding agreement between the lender and borrower, ensuring the vehicle remains in the borrower’s possession during the loan period. The process is relatively straightforward; borrowers can apply online, providing details about their vehicle and financial standing. This digital approach streamlines the application process, making it more accessible to those who may not fit traditional banking criteria.

Once approved, loan terms can vary depending on several factors, including the value of the vehicle and the borrower’s ability to repay. Car title loans offer a distinct advantage over conventional loans as they provide a faster and more flexible financing option. Borrowers can use the funds for various purposes, from covering unexpected expenses to consolidating debt. The simplicity and convenience of this method have made car title loans Port Arthur TX a go-to choice for many in need of immediate financial assistance.

Key Features That Differentiate Lenders

When it comes to choosing a lender for car title loans Port Arthur TX, several key features set them apart. Firstly, consider the loan approval process. Top-tier lenders offer same-day funding, ensuring quick access to cash when you need it most. This swiftness is particularly beneficial in emergency situations or when time is of the essence. Moreover, they provide flexible payment plans tailored to individual needs, making it easier to manage repayments without causing undue financial strain.

Another distinguishing factor is customer service. Lenders who excel in this area offer transparent communication, clear terms and conditions, and responsive support throughout the loan tenure. They may also have user-friendly online platforms for loan applications, making the entire process more convenient and less cumbersome. These elements collectively contribute to a positive experience for borrowers seeking car title loans Port Arthur TX.

Benefits and How They Impact Borrowers

Car title loans Port Arthur TX offer several benefits that set them apart from traditional loan options. One of the key advantages is their speed and convenience. Unlike bank loans, which often involve lengthy application processes and strict eligibility criteria, car title loans provide quick funding. Borrowers can obtain cash within a short period after applying, making them an attractive solution for urgent financial needs. This rapid turnaround time allows individuals to access the funds they require swiftly, ensuring they can take care of unexpected expenses or seize opportunities without delay.

Additionally, these loans are secured by the value of the borrower’s vehicle, which streamlines the loan approval process. With car title loans Port Arthur TX, lenders focus on the car’s equity rather than the borrower’s credit history. This means individuals with less-than-perfect credit or no credit history can still be eligible for funding. The simplicity and transparency of this approach make it an appealing choice for those seeking a straightforward and hassle-free loan experience, ultimately enhancing financial stability and providing much-needed relief during challenging times.

Car title loans Port Arthur TX offer a unique financial solution with several key differentiators. By understanding these loans and their benefits, borrowers can make informed decisions. The flexibility and accessibility provided by these lenders set them apart in the current market, ensuring that residents of Port Arthur TX have access to much-needed funds quickly and efficiently.